Shooting Star Candlestick Definition, Formation with Example.

What is a shooting star

pattern?

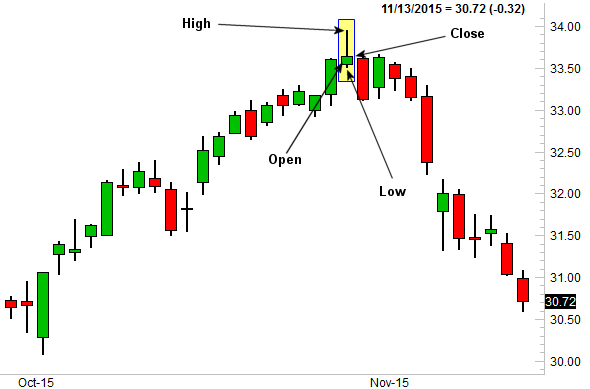

A shooting

star candlestick pattern is a bearish candlestick pattern that has a long upper

shadow with little or no down shadow and a small body. It helps us know the trend

of the market when there are uptrends and after some time in the upper ward, a

shooting star created then it show that the bear's trends should be continued.

This

candlestick pattern appears when you buyer is trying to pull up the market but

after some time it gets rejection and starts to continue falling down and it

makes then bearish shooting star candlestick pattern.

Key Points

- A shooting star is bearish candlestick pattern and it was made after a long rally.

- It is Bearish formation candle because after long bullish rally sellers were trying to push down the price of the stock and after some time bears were taking down the stock.

- After shooting star many traders wait for another candle if the price decline so many traders started short sell.

- If the price rise after shooting star, then many people who sell the stock start buying again. And then In this case it is a false shooting star candle.

How Do shooting star

candlestick pattern works

Shooting

star candle shows a trend reversal (toward bears side) when a stock goes upward

trend or after three to four green candle there is making a shooting star then

it shows the reversal of uptrend and bears were trying to take down the stock

to downward side.

It is not necessary that there should be an always

uptrend or three to four candles should upward but also in some cases when

there is a consolidate zone then also shooting star pattern will be made to

show the trend reversal toward the downside.

Now let’s

explain how this whole process work, first buyers pushed the trend upward

in the whole trading process after that seller was trying to stop the uptrend and

trying to reverse the trend after that many buyers will book the profit, and

then sellers will confident and more pulling down the stock. The uptrend now

reverses toward the downtrend and it makes a shooting star with a small body and

large up shadow.

How to trade Shooting star

candlestick pattern.

In early we

have read about shooting star & how it forms in this article. Now we will

study how to trade in shooting star patterns. At first, we will confirm that the

trend should be upward.

After that, we

will confirm that there is a shooting star pattern form in the chart, if you have

studied the article clearly then you know how to check the shooting star pattern.

Now you

need to wait for the next bearish candle for the confirmation of your trade.

Now sell

the stock and put a stop loss on the upward shadow of the shooting star pattern.

And take a

target according to the hole shooting star body if you achieved your target

then you can exit the trade or if you think you will get more from the trade

then you can put stop loss or trail your stop loss according to position and then

try to book more profit.

0 Comments

please do not enter any spam link in the comment box.